Calculate hourly rate from gross pay

Estimate the after-tax pay for hourly employees by entering the following information into a hourly paycheck calculator. For instance for Hourly Rate 2600 the Premium Rate at Double Time 2600 X 2 5200.

How To Calculate Overtime Pay From For Salary Employees Youtube

Determine how often youll pay your employeesweekly bi-weekly semi-monthly monthly or a different cadence all together.

. When use of an average hourly rate of pay is necessary the weekly rate of pay can be calculated by multiplying the hours worked in a week by the average hourly rate of pay as shown by the. Heres how that gross pay formula would look using a one-week pay period. Set the net hourly rate in the net salary section.

Then figure out your employees gross pay for the pay period. To determine gross pay multiply the number of hours worked by the pay rate. The pay compared with the gross and net income of the business as well as with distributions to shareholders if the business is a corporation.

Multiply their hourly rate by the number of hours they worked during the pay period. For instance if your hourly rate is minimum wage 950 and you work 8 hours per day you will get paid 76 each day. In 2017 the median hourly pay for part-time employees was 24 higher than in 2016.

How to calculate gross pay for hourly wages in one pay period. If the employee works overtime and is nonexempt multiply the hourly rate by 15 or the rate according to the overtime rules by state to get the overtime rate. Remember to adjust the first two fields of the calculator as necessary.

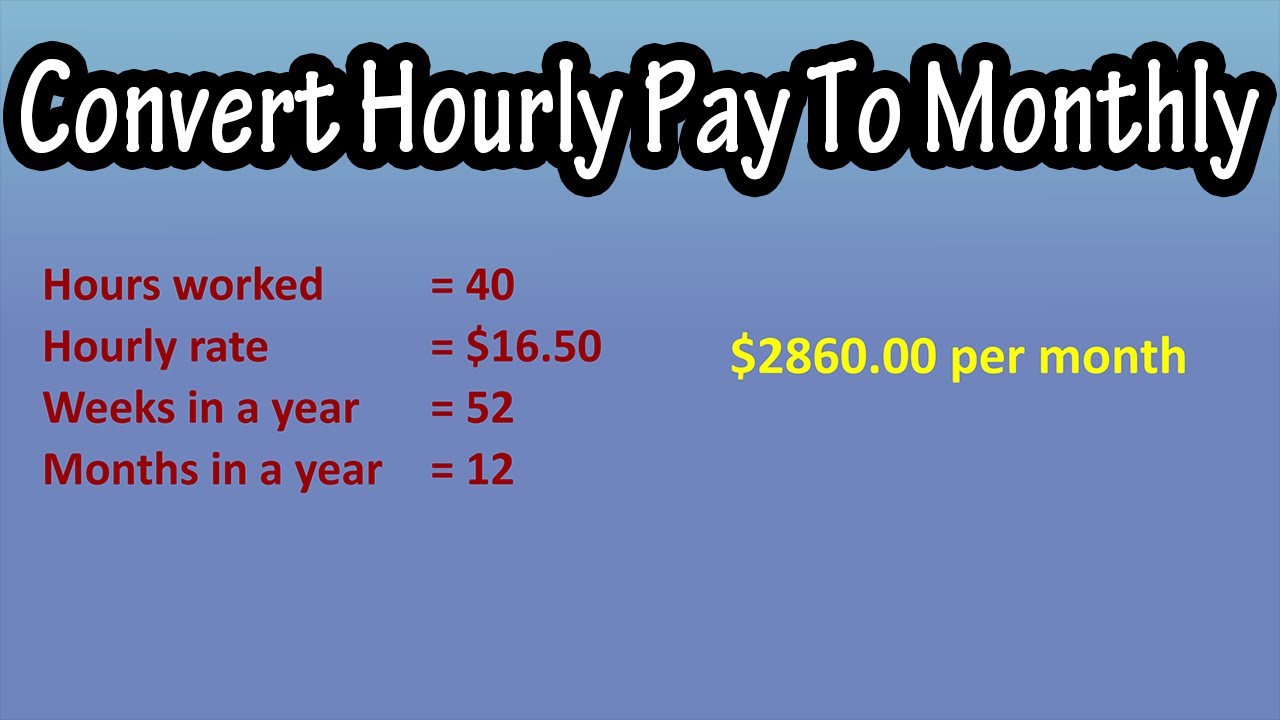

Hours worked in pay period x hourly pay rate gross pay per pay period. You calculate gross wages differently for salaried and hourly employees. Gross Pay 800.

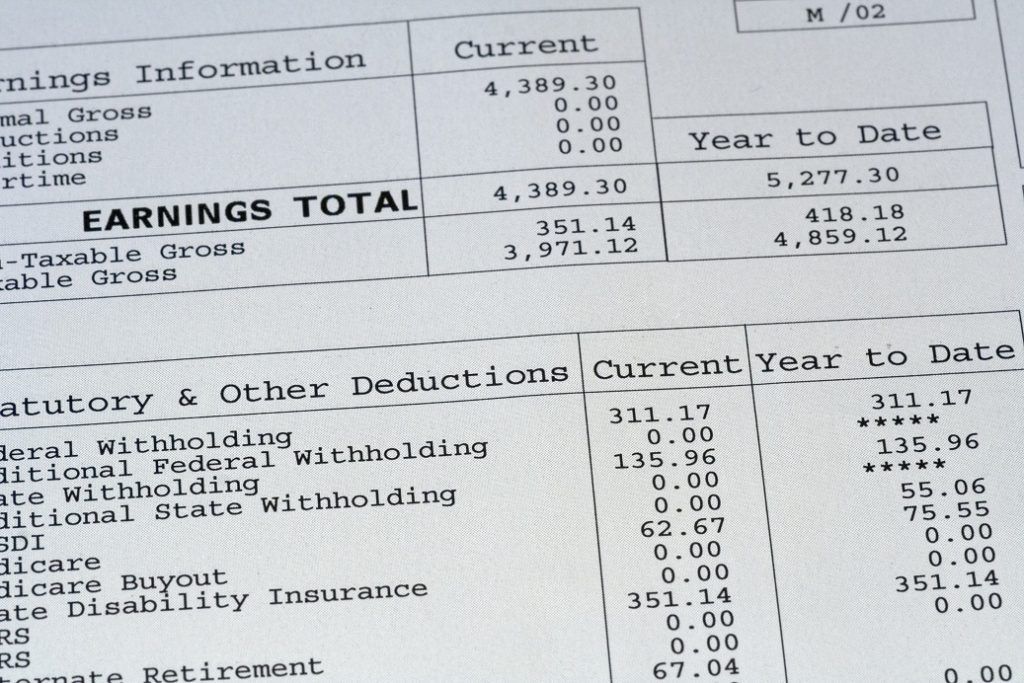

Thats Annas rate of vacation accrual. Annual salary 52 weekly rate. Heres a rundown of the withholding amounts we calculated.

The Pay Rate Calculator is not a substitute for pay calculations in the Payroll Management System. Any wage or salary amount calculated here is the gross income. The amount also called the pay rate must be agreed upon in writing before the start of employment.

The employee will need the difference paid as retro pay for the 40 hours in the prior period back to the date the raise. Employees on hourly rates get paid in wages and are typically paid weekly or monthly. The 40 hour work week is 5 8 hour days.

Calculating Gross Pay for Hourly Employees. Lets say the employee makes 15 per hour. Enter either your gross hourly wage into the first field or your gross annual income into the fourth field.

Overview of New York Taxes New York state has a progressive income tax system with rates ranging from 4 to 109 depending on taxpayers income level and filing status. The annual net income calculator will display the result in the last field. Annas total vacation time equals 80 paid hours per year or roughly 4 of the max possible hours she could work over 52 weeks sans overtime.

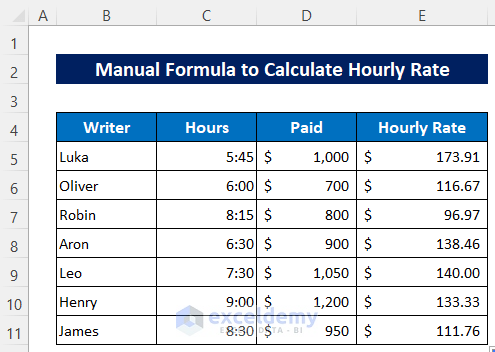

How to Calculate Hourly Pay. For premium rate Double Time multiply your hourly rate by 2. An employee received a pay raise of 115 an hour by the owner but the owner forgot to inform the payroll department.

Many people may already know their yearly salary but in the event that you dont check your most recent pay stubUse your gross not net paythat is your amount before taxesand multiply the number by the number of pay periods in a year. Monthly you make a gross pay of about 2083. Gross Pay Hours Worked in a Pay Period Hourly Rate Overtime Hours Hourly Overtime Rate Payroll.

Net Pay Gross Pay Deductions. To earn a gross pay of 10000month an employee makes 120000 annually and receives 12 paychecks. Hourly employees multiply the total hours worked by the hourly rate plus overtime and premiums dispersed.

This powerful tool can account for up to six different hourly rates and works. Salary employees divide the annual salary by the number of pay periods each year. For hourly employees multiply the total hourly rate by the number of hours worked for the pay period.

If you would like the paycheck calculator to calculate your gross pay for you enter your hourly rate regular hours overtime rate and overtime hours. To calculate net pay deduct FICA tax. Comparing part-time employees 29 growth in median weekly earnings with this 24 hourly pay increase suggests that median weekly earnings rose primarily because of higher pay rates within the set of part-time jobs filled by employees in 2017 compared with.

Total Monthly Living Expenses L Total Monthly Business Expenses B Total Billable Hours Per Month H Total Taxes T Your Minimum Hourly Rate LH 1 T BH Example. Gross pay per check decreases with additional pay periods. In the event of a conflict between the information from the Pay Rate Calculator.

You will see the hourly wage weekly wage monthly wage and annual salary based on the amount given and its pay frequency. For tax year 2021 the standard mileage rate for the cost of operating your car van pickup or panel truck for each mile of business use is 56 cents per mile. Get the timesheet or attendance log of the employee to know the.

Gross pay and pay frequency. Remember if they took any. Using the formula to calculate net pay determine the employees net pay.

Calculate your yearly income. 40 hours x 20 per hour 800 gross pay per pay period. First calculate your weekly rate.

Then enter the tax rate for both. Allowances and withholding information. And health insurance from the employees gross pay.

To compare annual earnings with industry averages divide your salary by the number of weeks you worked. Weekly rate hours worked per week hourly rate. If you dont want the download the free rate calculator above the math goes like this.

So lets say you need to make 5000month to live expect your business expenses to be about. A typical calculation for hourly employees is as follows. Federal state and local income taxes.

How to calculate gross pay for hourly employees. To get the gross pay at an hourly rate multiply the number of hours worked during the pay period by the hourly pay rate. Then calculate your hourly rate.

Multiply the hourly rate by the number of hours worked up to 40 hours per week. Net pay gross pay - deductions. Also include any additional income earned such as overtime.

For more information see chapter 11. Payroll runs the employees last paycheck using the old pay rate to calculate earnings. Now divide what you make weekly by the numbers of hours you work each week.

Use the following formula to calculate your net pay. You have a full-time hourly employee Anna who is eligible for up to two weeks vacation pay. Why 4 per year.

To calculate an employees gross pay start by identifying the amount owed each pay period. Your gross pay will be automatically computed as you key in your entries. The key to.

If you already know your gross pay you can enter it directly into the Gross pay entry field. An hourly rate as the name suggests is a set amount of money that the employer will pay for each hour that is worked. This amount is considered your gross pay.

Please note this is based on a 40 hour work week with 52 weeks per year and 12 months per year. To do this simply subtract your deductions from your gross pay. You determine that your monthly deductions amount.

This number is the gross pay. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Calculate 22 Column D of the earnings that are over 44475 Column E.

Lets say your yearly salary is 25000. The gross profit margin calculation can be done manually by first taking the total revenue or total sales of the company and then subtracting the cost of goods sold COGS to arrive at the gross profit number and then taking that gross profit number and. Try out this example.

Gross Pay And Net Pay What S The Difference Paycheckcity

Annual Income Calculator

Hourly Wage To Salary On Sale 55 Off Www Ingeniovirtual Com

Salary To Hourly Salary Converter Salary Hour Calculators

Hourly To Annual Salary Calculator Top Sellers 50 Off Www Ingeniovirtual Com

How To Calculate Gross Weekly Yearly And Monthly Salary Earnings Or Pay From Hourly Pay Rate Youtube

Hourly To Annual Salary Calculator Top Sellers 50 Off Www Ingeniovirtual Com

Gross Pay Definition Components And How To Calculate

How To Calculate Gross Pay Youtube

3 Ways To Calculate Your Hourly Rate Wikihow

Write A Program To Prompt The User For Hours And Rate Per Hour Using Input To Compute Gross Pay Pay The Hourly Rate For The Hours Up To 40 And 1 5 Times

Gross Pay And Net Pay What S The Difference Paycheckcity

How To Calculate Convert Monthly Salary Earnings Pay From Hourly Pay Rate Formula Monthly Pay Youtube

Hourly To Salary What Is My Annual Income

8 Hourly Paycheck Calculator Doc Excel Pdf Free Premium Templates

Hourly Rate Calculator Plan Projections

How To Calculate Hourly Rate In Excel 2 Quick Methods Exceldemy